1099 gambling winnings|Topic no. 419, Gambling income and losses : Tuguegarao If you're a nonresident alien of the United States for income tax purposes and you have to file a tax return for U.S. source gambling winnings, you must use Form 1040-NR, . Tingnan ang higit pa Mindanaotoday.com | Arrest of foreigners involved in lewd acts in Siargao lauded By: Alexander Lopez. BUTUAN CITY – Mayor Sol Matugas of General Luna town in Siargao Island, Surigao del Norte on Wednesday acknowledged the police for arresting four foreign nationals recently involved in a public display of “lewd and obscene acts.” “We .

PH0 · What Taxes Are Due on Gambling Winnings?

PH1 · Topic no. 419, Gambling income and losses

PH2 · Taxes on Gambling Winnings & Losses: Gambling

PH3 · Sports Betting Taxes: How They Work, What's

PH4 · How to Pay Taxes on Gambling Winnings and Losses

PH5 · Gambling Winnings Taxes: An Intro Guide

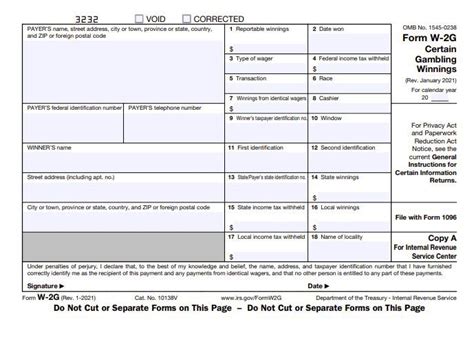

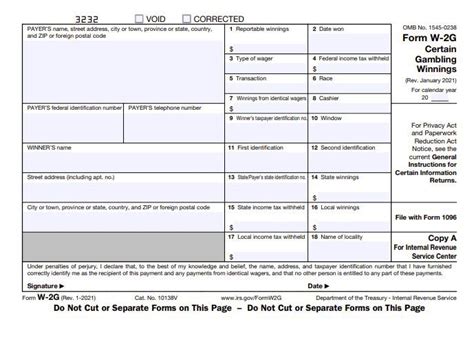

PH6 · Form W

PH7 · Do You Receive A 1099 For Gambling Winnings?

The gaming service is brought to you by Rush Street Interactive PA, LLC ( license# 110298) licensed by PGCB, address of record 1001 N. Delaware Avenue Philadelphia, PA 19125, on behalf of SugarHouse HSP Gaming, LP d/b/a Rivers Casino Philadelphia (Internet Gaming Certificate 1356)

1099 gambling winnings*******A payer is required to issue you a Form W-2G, Certain Gambling Winnings if you receive certain gambling winnings or have any gambling winnings subject to federal income tax withholding. You must report all gambling winnings on Form 1040 or Form 1040-SR (use Schedule 1 (Form 1040)PDF), including . Tingnan ang higit paYou may deduct gambling losses only if you itemize your deductions on Schedule A (Form 1040)and kept a record of your winnings . Tingnan ang higit paTo deduct your losses, you must keep an accurate diary or similar record of your gambling winnings and losses and be able to provide receipts, tickets, statements, or other records that show the amount of both your . Tingnan ang higit paIf you're a nonresident alien of the United States for income tax purposes and you have to file a tax return for U.S. source gambling winnings, you must use Form 1040-NR, . Tingnan ang higit pa

For additional information, refer to Publication 525, Taxable and Nontaxable Income or review How do I claim my gambling winnings and/or losses? Tingnan ang higit pa Form W-2G is an Internal Revenue Service document that a casino or other gambling establishment sends to customers who had winnings during the prior year that must be reported as income to the.WEBA 1099 form for gambling winnings is issued if you receive $600 or more in winnings from certain types of gambling activities. Keeping accurate records of your winnings . Key Takeaways. • You are required to report all gambling winnings—including the fair market value of noncash prizes you . The IRS has clear-cut rules on gambling income that predate the recent explosion of the sports betting industry. In short, the proceeds from a successful sports wager are taxable income, just.

Learn how to report gambling winnings and losses on your tax return, when to get a Form W-2G, and how to deduct your losses. Find out the thresholds, withholding rates, and exceptions for different .

This form is similar to the 1099 form and serves as a record of your gambling winnings and as a heads-up to the IRS that you’ve hit the jackpot. You then must report all gambling winnings on your tax .

This form is similar to the 1099 form and serves as a record of your gambling winnings and as a heads-up to the IRS that you’ve hit the jackpot. You then must report all gambling winnings on your tax . Gambling winnings are fully taxable so you won't get to keep every penny even if you beat the odds and win big. The Internal Revenue Service (IRS) has ways of ensuring that it gets its share..

The tax rate on gambling winnings will typically vary from state to state. The majority of states have income taxes, which means that gambling winnings are likely subject to both federal and state taxation. . Payments of gambling winnings to a nonresident alien individual or a foreign entity aren't subject to reporting or withholding on Form W-2G. Generally, gambling winnings paid to a foreign person are subject to 30% withholding under sections 1441(a) and 1442(a) and are reportable on Form 1042, Annual Withholding Tax Return for U.S. .

The statement is known as the W-2G, and it includes an overview of your gambling winnings, . 1099 Form: Definition, Who Gets One, How It Works. Dive even deeper in Taxes.WEBTaxes - Frequently Asked Questions - W-2G, 1099, winnings and more. This FAQ covers frequent tax questions that we receive about our Online Sportsbook, Daily Fantasy, Racing, Faceoff, and Online Casino products, and the IRS-required “Tax Forms” associated with your play on our products. This FAQ is intended to provide general answers to .

Topic no. 419, Gambling income and losses WEBIf your winnings are reported on a Form W-2G, federal taxes are withheld at a flat rate of 24%. If you didn’t give the payer your tax ID number, the withholding rate is also 24%. Withholding is required when the winnings, minus the bet, are: More than $5,000 from sweepstakes, wagering pools, lotteries, At least 300 times the amount of the bet.WEBTo deduct gambling losses, you must provide records that show the amounts of both your winnings and losses, like: Receipts. Tickets. Statements. Enter your winnings in the Form W-2G topic or as Other Income. To deduct gambling losses, you must itemize your deductions: Claim your gambling losses as a miscellaneous deduction not subject to .WEBGenerally, if you receive $600 or more in gambling winnings, the payer is required to issue you a Form W-2G. If you have won more than $5,000, the payer may be required to withhold 28% of the proceeds for Federal income tax. However, if you did not provide your Social Security number to the payer, the amount withheld will be 31%.1099 gambling winnings Topic no. 419, Gambling income and losses All gambling winnings are subject to federal income tax, and will be taxed at the same rate as your other income. . Form W-2G: For your gambling income; Form 1099: For prizes and promotions from a gambling platform; Both are intended to document income you received on the platform. Whichever form you get, the IRS also receives a .

WEBA payer is required to issue you a Form W-2G (PDF) if you receive $600 or more in gambling winnings or if you have any gambling winnings subject to Federal income tax withholding. The $600 amount is increased to $ 1,200 for winnings from bingo or slot machines and to $ 1,500 for winning from Keno. In addition, if you make 300 times the .1099 gambling winningsWEBBecause the winnings ($5,002 - $1 = $5,001) are more than $5,000, you must withhold 24% of $5,001. You must prepare Form W-2G for E and a separate Form W-2G for S using the information furnished to you on Form 5754. -6- Instructions for Forms W-2G and 5754 (Rev. 01-2021) Withholding and backup withholding. Additionally, any gambling winnings that qualify for federal reporting do the same for NY taxes, too. . The amount on the 1099, along with those of any other 1099 forms you have for the year, goes on Line 21 of your IRS 1040. For your state taxes, you’ll need form IT-1099-R. This essentially allows you to summarize all your 1099 forms for . Taxable Gambling Income. Gambling income is almost always taxable income which is reported on your tax return as Other Income on Schedule 1 - eFileIT. This includes cash and the fair market value of any item you win. By law, gambling winners must report all of their winnings on their federal income tax returns.

A gaming facility is required to report your winnings on a W-2G when: Horse race winnings of $600 or more (if the win pays at least 300 times the wager amount) Bingo or slot machine winnings are $1,200 or more. Keno winnings, less the wager, are $1,500 or more. Poker tournament winnings are more than $5,000. If you receive multiple W .

Gambling winnings, per the IRS, “are fully taxable and you must report the income on your tax return. Gambling income includes but isn’t limited to winnings from lotteries, raffles, horse races and casinos. . In the alternative, you might receive a 1099-MISC or a 1099-K from the payer. This is particularly true if they use some form of .WEBWe would like to show you a description here but the site won’t allow us.WEBInstructions to Winner. Box 1. The payer must furnish a Form W-2G to you if you receive: $1,200 or more in gambling winnings from bingo or slot machines; $1,500 or more in winnings (reduced by the wager) from keno; More than $5,000 in winnings (reduced by the wager or buy-in) from a poker tournament; $600 or more in gambling winnings . Gambling winnings are fully taxable in North Carolina. Learn what state and federal taxes are due, how to report your winnings, and forms required. NC Sports Betting. . You may have received a Form 1099-MISC before when earning income for freelance work or other types of employment. Sometimes winning cash or some other .WEBGambling winnings and losses must be reported separately on an individual’s tax return, and the amount of gambling losses can never exceed the gambling winnings reported. . awarded more than $600 in miscellaneous gambling winnings within a tax year will report their income to the IRS using a 1099-MISC tax form that is filled out by the .

Online Pacific Poker (No longer recommended. Redirected to BetOnline Poker. . Download and No Download Poker. Introduction. Online poker room that shows the live number of poker players and tables on their front page. You can also see how many live players there are per game. The most popular poker game is Texas Holdem.

1099 gambling winnings|Topic no. 419, Gambling income and losses